Property Taxes Just Went Up? We’ve Got You Covered!

It’s reassessment season for most folks in our area. Homeowners

After the appraisal has been turned in, it usually goes through a review process by either an appraisal reviewer, or loan underwriter. Every financial institution has different standards by which they review the appraisal. The financing also comes into consideration when checking the appraisal for accuracy, making sure it meets all necessary guidelines. However, it is an unfortunate common occurrence to see an overzealous underwriter or reviewer, make unsubstantiated revision requests, based on an incorrect understanding of the appraiser’s standards and criteria. Two of the most commonly requested revisions in FHA appraisals are:

[bctt tweet=”This blog is divided into two parts” username=”RiverfrontApp1″]. The first part is directed towards underwriters, loan officers, reviewers, and other readers of appraisal reports; while the second half of the blog is directed towards appraisers. I’ll give you some language to put into your reports so you can do your part to reduce the number of unnecessary revisions as well.

Here is what you need to know about the two revisions mentioned above. The language below is taken directly from the HUD 4000.1 Handbook.

Appliances:

To go directly to a searchable pdf version of the HUD 4000.1 Handbook, click here.

Appliances that are to remain and that contribute to the market value opinion must be operational.

and also

The Appraiser must note all appliances that remain and contribute to the Market Value.

Note: If the appraiser mentions in their report that the appliances do not contribute to the market value of the property, then testing appliances is not required. If you see this comment, no request for revisions should be made. Appliances not contributing to the overall market value of a property is quite common. Many appliances are old or outdated, and are usually one of the first things many homeowners swap out when they purchase a home. An exception is made, of course, for a remodeled kitchen or a new home. Even then, however, it is very difficult to determine how much these appliances contribute in value.

Septic Tank Distance:

FHA states: The Appraiser must also be familiar with the minimum distance requirements between private wells and sources of pollution and, if discernible, comment on them. The Appraiser is not required to sketch or note distances between the well, property lines, septic tanks, drain fields, or building Structures but may provide estimated distances where they are comfortable doing so. When available, the Appraiser should obtain from the homeowner or Mortgagee a copy of a survey or other documents attesting to the separation distances between the well and septic system or other sources of pollution.

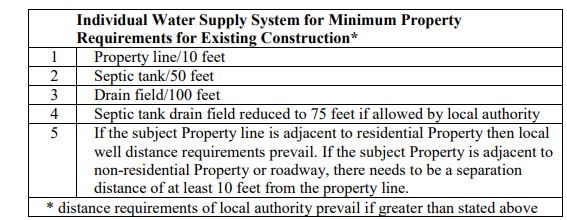

A table also provided by HUD is helpful:

What this table shows, is that an individual water supply system (i.e. well) must be at least 50 feet from the septic tank, and at least 100 feet from the drain field. There is no distance requirement in general, for the location of a septic tank (from the house or property line, for example).

Note: If the appraiser indicates that the home is serviced by public water, but also has a private septic system, then FHA does not require any distance calculations, nor does it require the appraiser to comment on the location of the septic system. The only time distance comments must be made is if the property has a private septic system AND is serviced by a private well/water source. What FHA is concerned with here, is pollution. They want to make sure the drinking water cannot be polluted by any septic tank (leaking, etc).

If you’re an appraiser and you loathe unnecessary revision requests as much as I do, then be proactive. Feel free to copy & paste these comments into your report and if the reviewer reads your report carefully, you should see a drastic reduction in the number of unnecessary revision requests.

Appliances:

“The appliances being conveyed do not quantifiably contribute to the overall market value of the subject property and were therefore not tested per FHA standards.” (Easy, right?!). Now of course, if you determine that any of the appliances do contribute to the market value, you need to test them and comment if they are operational or not.

Septic Tank Distance:

“It is common in this portion of rural xx County for properties to be serviced by a private sewer system. Public sewer is not available at the subject property and the cost to supply the subject property with public sewer would greatly exceed the market value of the subject property, thus making such an endeavor prohibitive. The septic system appears to be functional (from an interior inspection of the plumbing systems) and no visually obvious problems exist. The exact location of the septic system could not be determined; however, no signs of failure, and no surface evidence of malfunction was noted. While the sewer system is private, the water system is public; therefore, per HUD guidelines, disclosure of the septic system location is not required.”

No one likes revision requests. Reviewers don’t like sending them, appraisers don’t like addressing them, and all other parties to the transaction don’t like waiting on them. So, if you underwrite loans and/or review appraisal reports, please make sure you are up to speed on FHA standards before making unnecessary revision requests that waste time. And, if you’re an appraiser, you too need to make sure you are well aware of the standards by which we are held. Write your reports clearly, and work in a way as to preempt the revision requests discussed in this blog.

It’s reassessment season for most folks in our area. Homeowners

I feel like we all need a laugh. How about

So this may be a slight break from the norm,

Riverfront Appraisals has been providing comprehensive valuations of residential properties to Western Kentucky and Southwestern Indiana since 2008.